- #Recommended accounting software for small business full#

- #Recommended accounting software for small business trial#

- #Recommended accounting software for small business plus#

On the plus side, Software-as-a-Service (SaaS) means your tech is always up to date. The other change that has happened is the rise of monthly subscription as opposed to a one-off software licence. Back in the 1970s, the US television industry coined the phrase, “If you’re not paying for the product, you are the product.” These days that means that the software provider sells on your data.

#Recommended accounting software for small business trial#

Large business £24pm + VAT with 50% discount for three months if you sign up during one-month free trial Standard: £10 pm with 2 users and up to 5,000 invoices Simple Start is £6 for four months, rising to £12pm + VAT Essentials is £10 for the first four months, rising to £20pm + VAT Standard (includes invoicing and cash flow management): free for three months then £24pm + VAT

Partnership/LLP: £12 a month + VAT for 6 months then £24 a month + VAT Lite: £11pm + VAT with first three months 50% discount

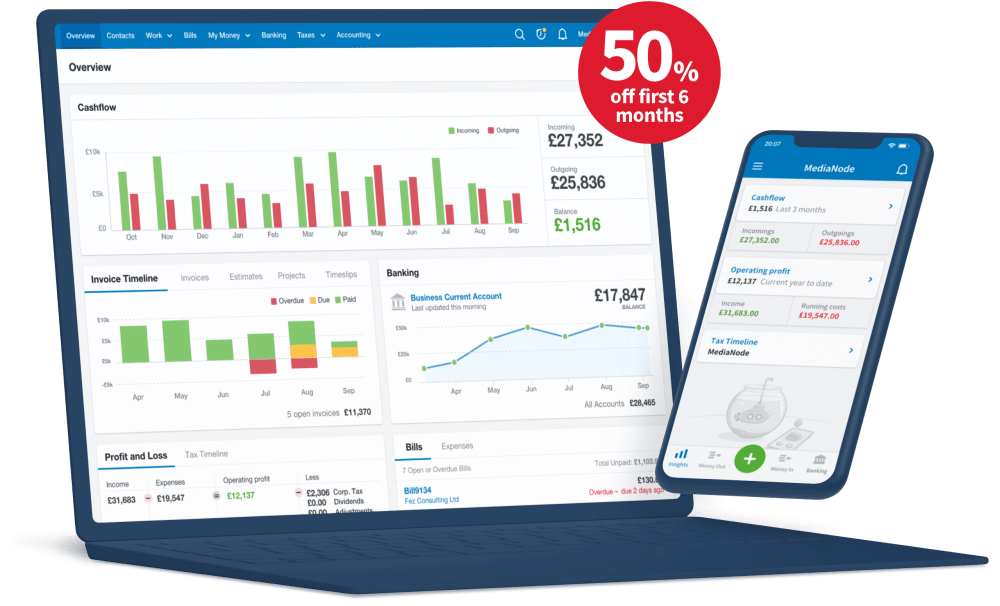

Small business £12pm + VAT with 50% discount for first three months if you sign up during one-month free trail Starter £10pm allows you to send 5 invoices and quotes, enter 5 bills, reconcile 20 bank transactionsįree: for businesses with less than £35,000 turnover pa, 1 user, up to 1,000 invoices Quickbooks is offering a 50% discount for the first six months. Sole trader: £9:50 a month + VAT for 6 months then £19 a month + VATĪccounting Start for sole traders and microbusinesses: free for three months then £12pm + VAT a month

#Recommended accounting software for small business full#

New users get a 50% discount for first 6 months, then it goes full price. Best accounting software for UK small businesses 2021 Indeed, most UK small business accounting software offers the same features, it’s just that you may feel more comfortable with how one is designed over another – and then of course, there’s the cost. Most small businesses can make do with basic functions like invoicing, bank reconciliation, income and expense tracking and financial report generation. Best UK small business accounting softwareĮvery small business is different.

0 kommentar(er)

0 kommentar(er)